Payment cloaking solution for high-risk merchants

Process payments for your high-risk project using Paytree and disguise the origin of your customers and website from your payment gateway. Suitable for projects such as adult, finance, gaming and many more.

Working with the following payment providers

Turnkey Cloaking Solution

Reliable and scalable cloaking solution

Providing high-risk merchants all the necessary tools to process payments, manage their payment flow and manage various risk to operate with longevity and stability.

Access a wide financial ecosystem

A single integration with unlimited opportunities

Paytree enables you to process payments for high-risk projects worldwide, quickly and securely, using the local payment methods your customers trust.

With our robust and secure technology, you can easily integrate with multiple payment gateways through a single API, giving you access to a wide range of payment methods.

This seamless integration allows you to manage complex, high-risk transactions efficiently, while increasing your acceptance rate.

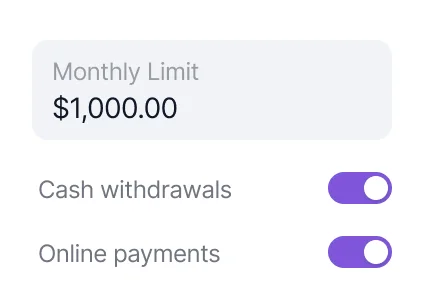

Tools to manage your risk

Rotate your accounts to stay under the radar

Paytree allows you to rotate your payment flow across various accounts, effectively distributing the payments across various payment gateways.

This feature helps you manage your payments more efficiently, reduce the risk of overloading any single account, and maintain a lower profile by avoiding suspicious activity or transaction patterns.

With this level of flexibility, you can easily manage risk profiles across various accounts to keep chargeback ratios low and reduce the risk of account closures.

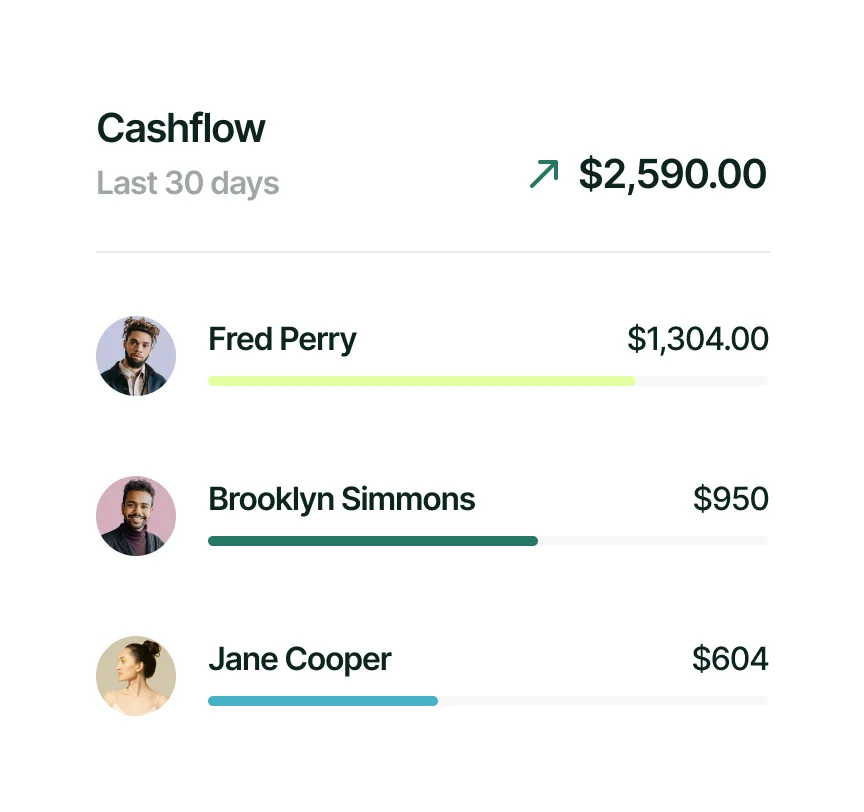

Source of truth

Consolidate your payment flow with Paytree

Consolidating your payment flows offers a single source of truth for all your transactions. With unified reporting, real-time insights, and streamlined management, you’ll save time and reduce complexity.

Beyond improved reporting, our platform also boosts acceptance rates, lowers processing costs, and enhances transaction success. Enjoy the benefits of better efficiency, cost savings, and higher conversion — all from one solution.

Jump start your processing

Our platform provides a robust and scalable infrastructure with all the necessary tools to process and manage payments for your high-risk project.

Features and Benefits

The wildcards you’ve been waiting for

Multiple Payment Methods

Accept a variety of payment methods such as cards, crypto and wires (Open Banking) with a single integration.

Pre-built Integrations

Seamless and instant integration with a variety of platforms such as WordPress with pre-built plugins and modules.

Enhanced Privacy Control

Designed for flexibility and privacy, we facilitate transactions while managing payment flow and origins discreetly.

Routing & Orchestration

Route payments based on defined rules to achieve your desired outcome, i.e. reduce costs, load balance payments, etc.

Reporting & Analytics

Gain real-time insights into transactions, performance, and trends with reporting, empowering data-driven decisions.

Finance & Reconciliation

The ledger module handles settlement, invoicing, currency conversions and fee calculations for seamless operations.

Frequently asked questions

Do I require my own merchant account (MID) to use Paytree?

Yes, we do not provide merchant accounts (MIDs). In order to use Paytree, you will require accounts with processors or banks, such as Stripe, Mollie, Adyen, etc.

Do you support my payment gateway(s) / merchant account(s)?

Paytree is currently integrated with Stripe, Airwallex and Paypal. Contact us to integrate your payment gateway if you are not using either of these options.

Do you have any plugins available for popular platforms?

Yes, please refer to our documentation.

Flexible pricing, fair and simple

Lite

€500

/ mo

Idea for companies operating a single website or brand.

- Payment orchestration, routing and risk management

- Unlimited number of connected payment gateways

- Full suite of detailed analytics and reporting

Lite+

€400

/ per site / mo

Ideal for the ambitious operating multiple websites or brands.

- Payment orchestration, routing and risk management

- Unlimited number of connected payment gateways

- Segregated accounts for analytics and reporting